ESG Integration

At FSN Capital, we focus on the financial risks and opportunities arising from the various ESG topics, and our standard ESG approach is deeply integrated in our Investment Technology

Pre-investment period

Investment process

Ownership period

Value Creation Process

All portfolio companies establish ESG priorities

All portfolio companies adopt and implement ESG policies with clear governance

All portfolio companies set Science-based targets

All portfolio companies have at least one female board member

Frameworks

ESG in sourcing and due diligence

PURPOSE: Identify ESG risks and opportunities to manage and capitalize on

FSN Capital Partners has developed a three-step mandatory approach to integrating ESG into our sourcing and due diligence processes. In the sourcing phase, the deal team first screens the target company against our Responsible Investment Policy. Second, the deal team conducts a high-level climate change assessment of physical and transition risks in the company’s entire value chain. During the due diligence process, the deal team then partners with external experts to conduct a more detailed, double materiality-aligned ESG due diligence based on FSN Capital Partners’ standard ESG due diligence scope.

This process enables us to identify ESG risks and opportunities the company can manage and capitalize on during the ownership period and feeds into the development of the company’s commercial strategy and ESG Priorities.

Moritz Madlener, Investment Manager, on how ESG screening and due diligence supports the larger FSN Capital investment process

Information from the ESG due diligence is incorporated into the investment decision material and provides the basis for how we can help support the company address risks and capitalize on opportunities during the ownership period.

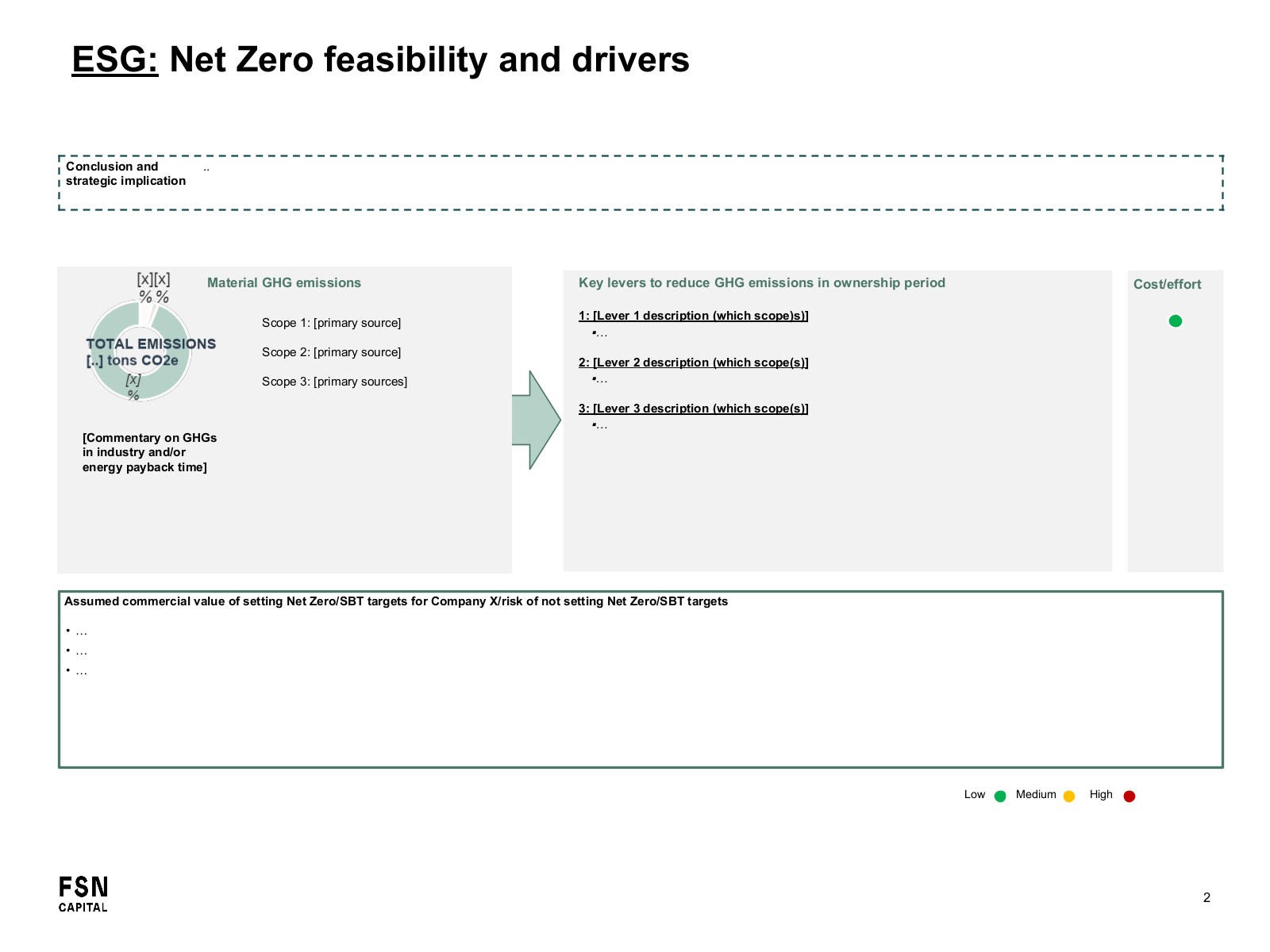

External consultants conduct an assessment to evaluate the feasibility, costs, and commercial value of reducing GHG emissions and setting Science-based Targets.

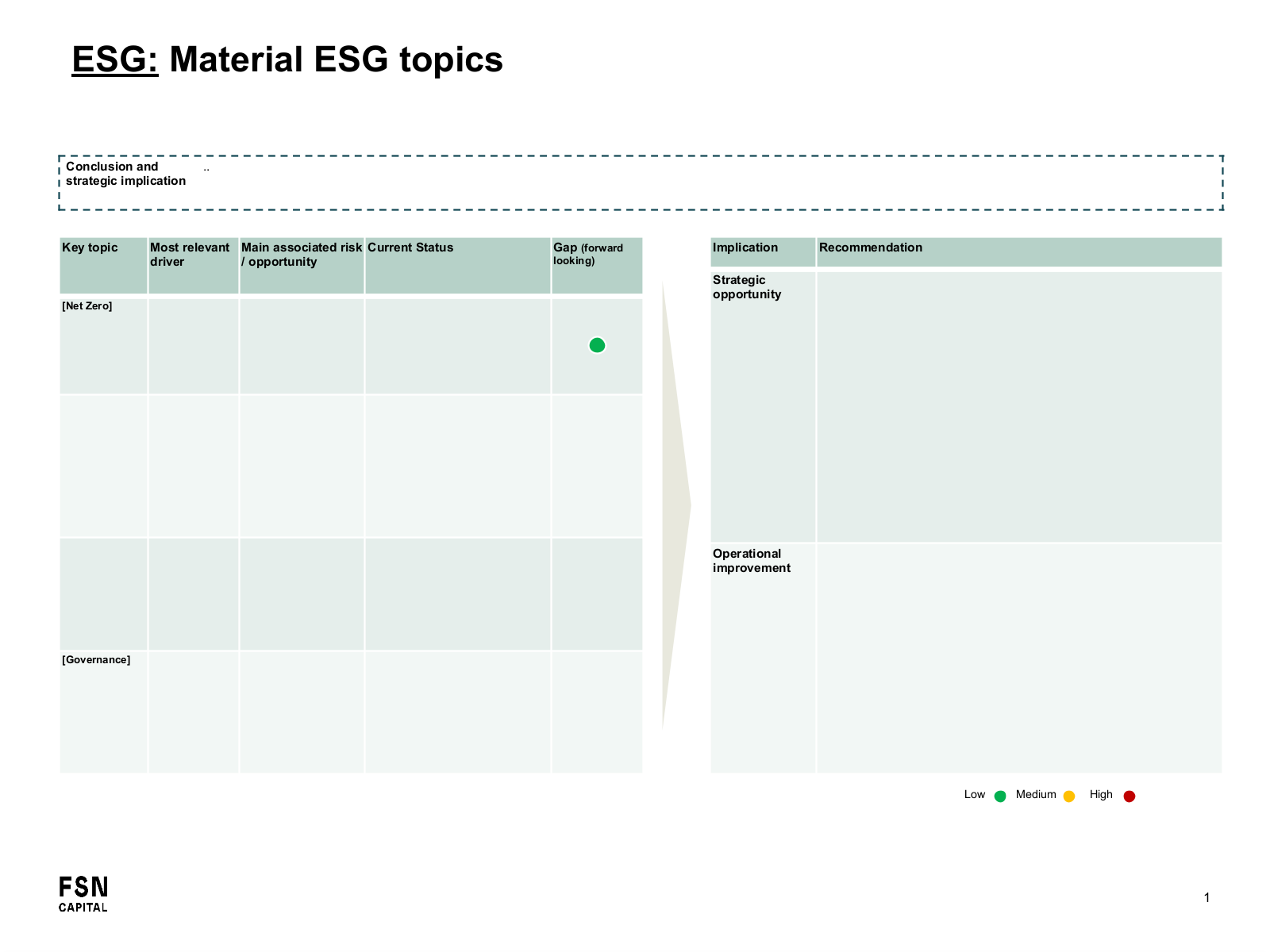

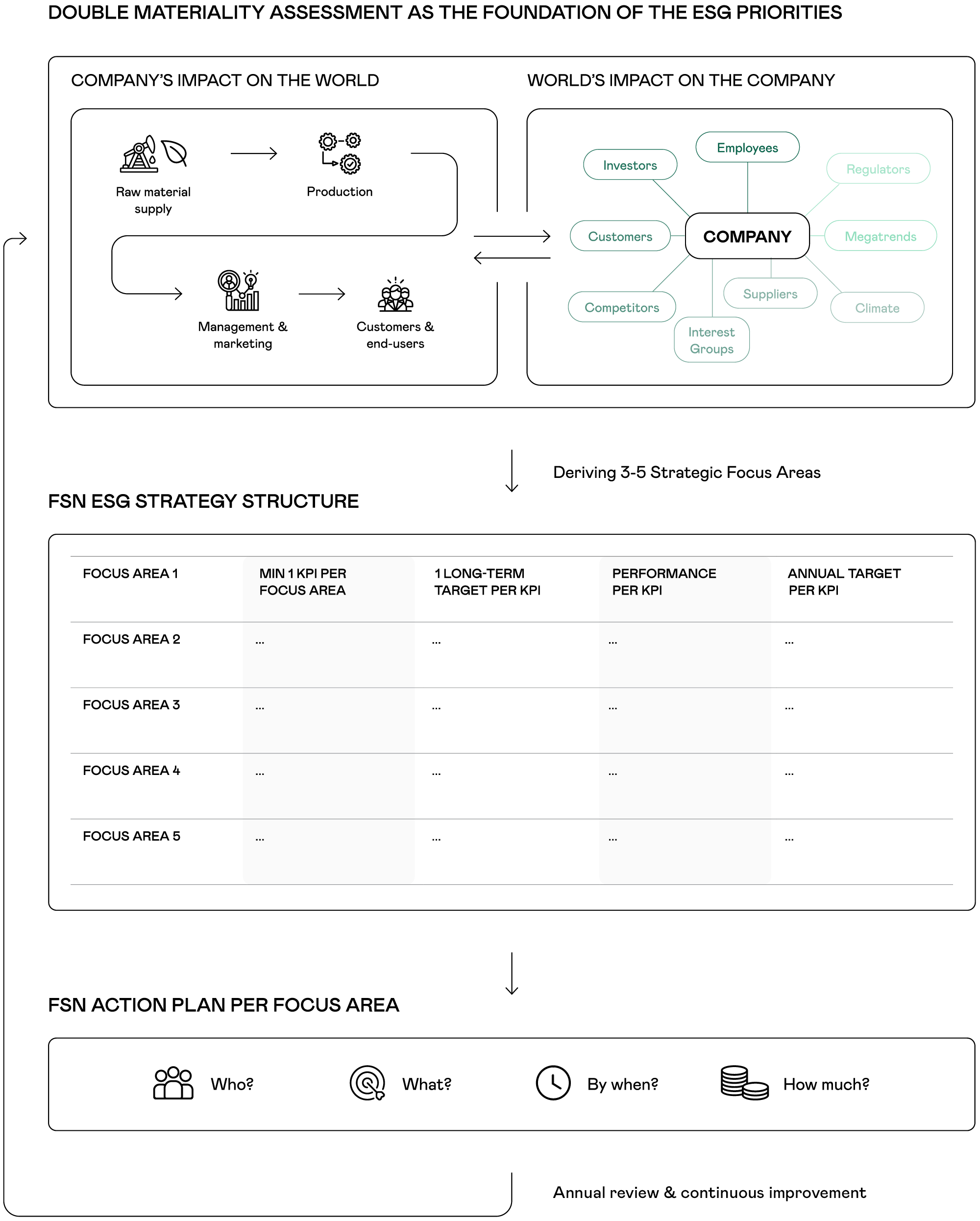

ESG Priorities

PURPOSE: ENSURE POSITION AS A SUSTAINABILITY LEADER

We believe that to become a winner in any industry, you must also be a sustainability leader – and the ESG Priorities approach ensures focus on the material ESG topics. The basis for this work is the ESG due diligence. Having a holistic approach to ESG allows portfolio companies to be agile as they see the bigger picture and can be proactive rather than reactive to emerging sustainability trends.

Each FSN portfolio company management team creates ESG Priorities consisting of 3-5 material ESG focus areas with relevant KPIs. For each KPI, the management identifies both long-term (3-5 year) and short-term (annual) targets. The FSN Capital ESG team takes part in the development of every portfolio company’s ESG Priorities. This allows for sharing of best practice across the FSN portfolio.

Further, following the FEF process, each portfolio company is to create an ESG action plan to meet the annual targets under their ESG Priorities. The ESG priorities and action plan are subject to annual review and update.

Access portfolio companies’ ESG Priorities here by clicking relevant company name.

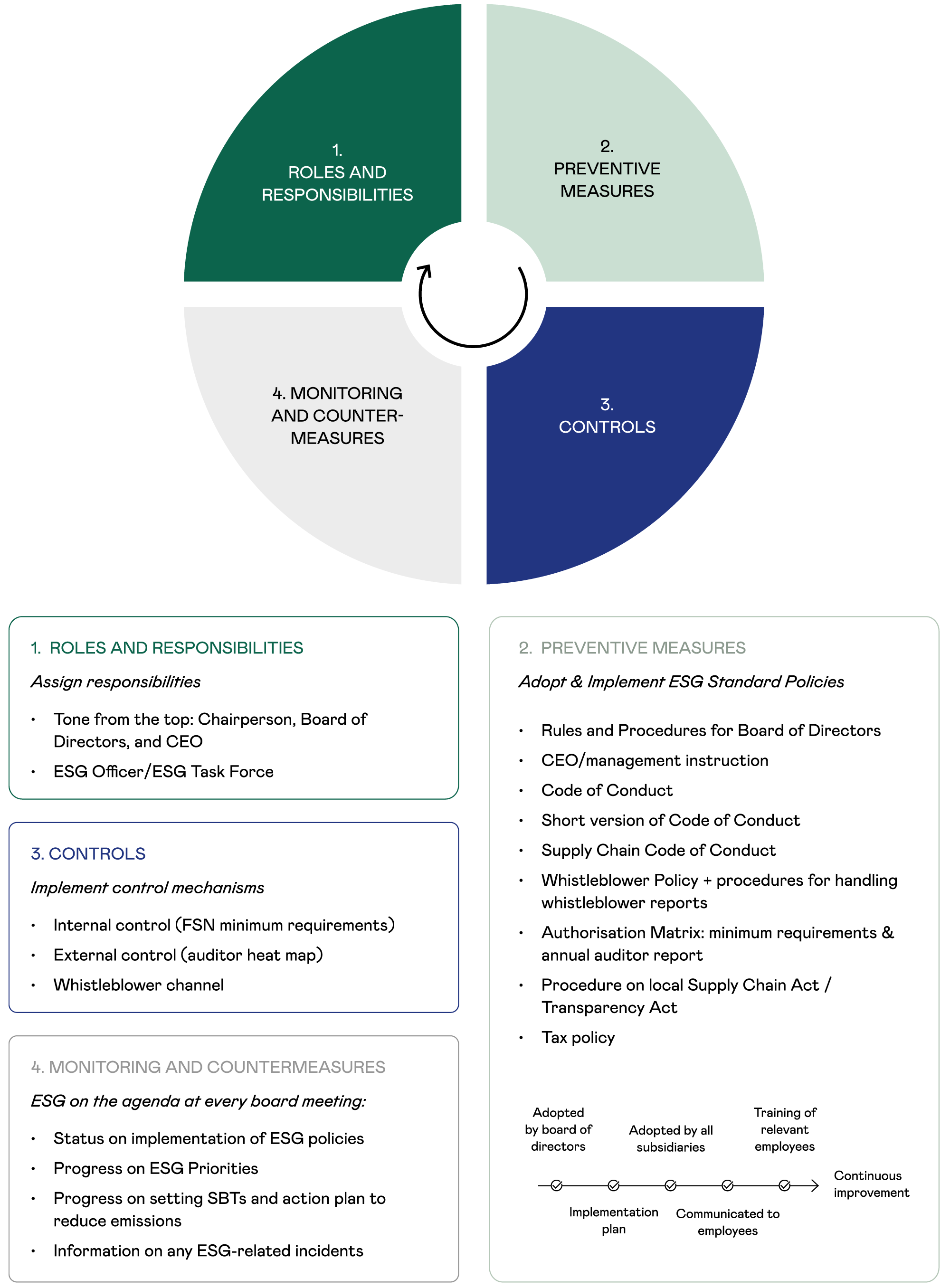

Governance

PURPOSE: TO ENSURE CONTROL AND REDUCE RISK

Our Governance approach defines roles and responsibilities with clear expectations for the Chairperson, board of directors, and portfolio company management. The board of directors is responsible for ensuring good governance and high ethical business standards, which entails implementation of robust ESG policies. Further, we require all portfolio companies to assign an ESG Officer to coordinate ESG initiatives across the organization.

As part of the ESG onboarding program, management will tailor FSN’s standard ESG policies and prepare a plan for implementation. These policies include compliance with laws, human rights, anti-corruption, antitrust, and sanctions. The plan must integrate ethical standards throughout each portfolio company – with a focus on building ESG knowledge through training of employees. This approach seeks to ensure lasting change and improvement beyond our ownership period.

ESG is expected to be the first thing on the agenda in every portfolio company board meeting. This agenda item includes an update on all three standard ESG approaches. The board of directors is responsible for driving the ESG agenda and having it on the agenda keeps the momentum up.

Decarbonization

PURPOSE: TO PREPARE PORTFOLIO COMPANIES FOR A NET ZERO FUTURE

We believe that our decarbonization approach enables our portfolio companies to meet stakeholder expectations and prepare for a Net Zero GHG emissions future. FSN Capital is committed to being aligned with the Paris Agreement. For this reason, we rely on the guidance of the Science-Based Targets initiative (SBTi) to set targets for FSN Capital and portfolio companies.

One tool we use to support portfolio companies is the marginal cost of abatement curve. This curve shows the cost of available reduction initiatives and their GHG reduction potential, enabling portfolio companies to prioritize those with the lowest cost and greatest impact. While some decarbonization initiatives will come at a premium, we believe that by also implementing initiatives with a negative cost of abatement, portfolio companies can make meaningful progress on their decarbonization journeys before incurring additional net costs.

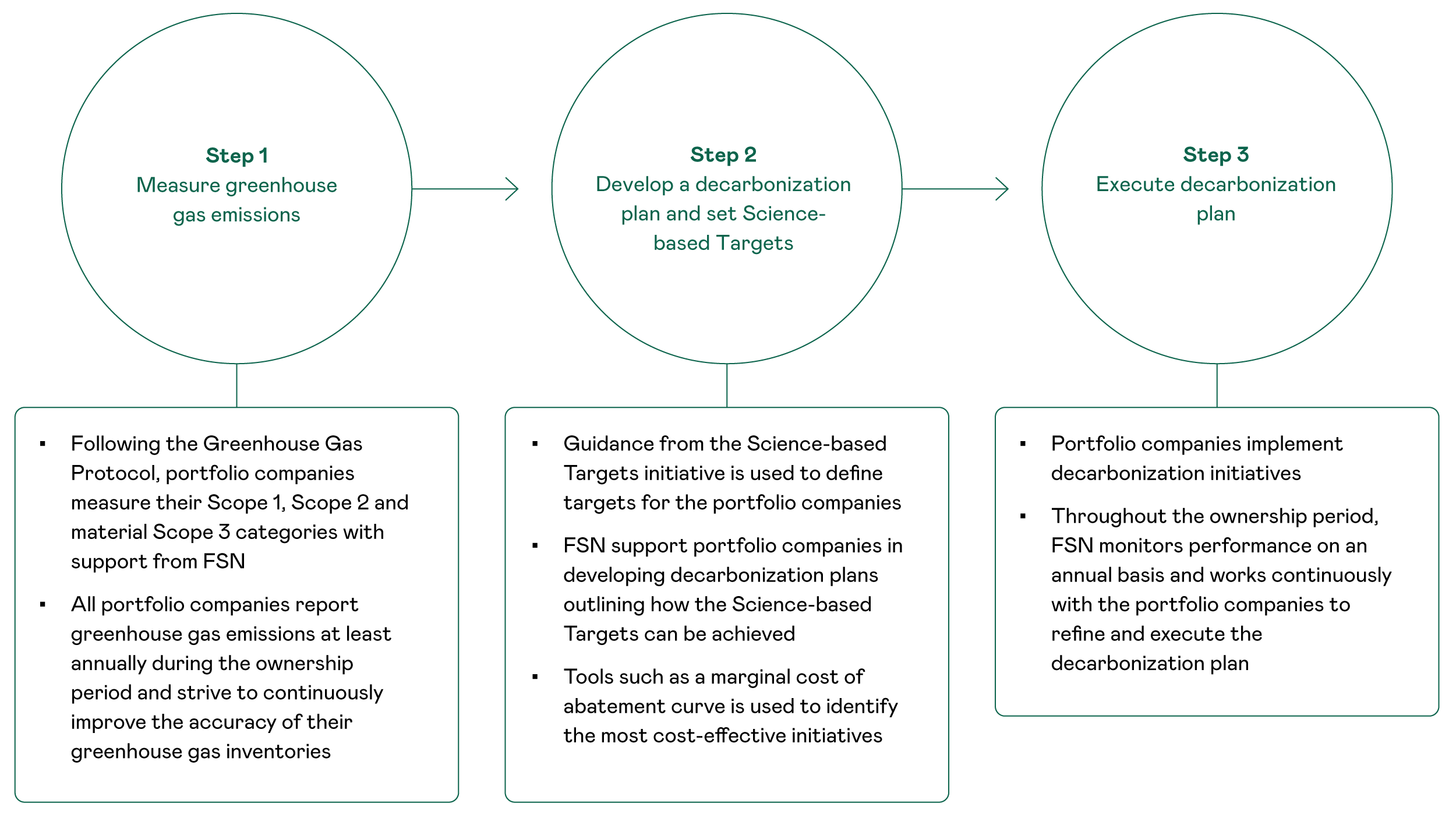

We have developed a three-step decarbonization approach:

- With support from FSN and external consultants, portfolio companies measure their scope 1-3 emissions following the Greenhouse Gas Protocol guidelines and manage their GHG inventory in an online software;

- We support our portfolio companies to set SBTi targets and develop decarbonization plans to achieve them; and

- Portfolio companies execute decarbonization plans and FSN monitors performance while being available for ongoing sparring.

Active Brands’ journey to setting Science-based Targets

Diversity

PURPOSE: Promote diversity of thought

At FSN Capital, we know that diversity drives returns. On the Winning Together page, we explain how we promote diversity internally at FSN. On this page, you will learn more about how we promote diversity and inclusion on portfolio company boards of directors – and why we believe it is so important to do so.

We drive diversity because diversity drives returns

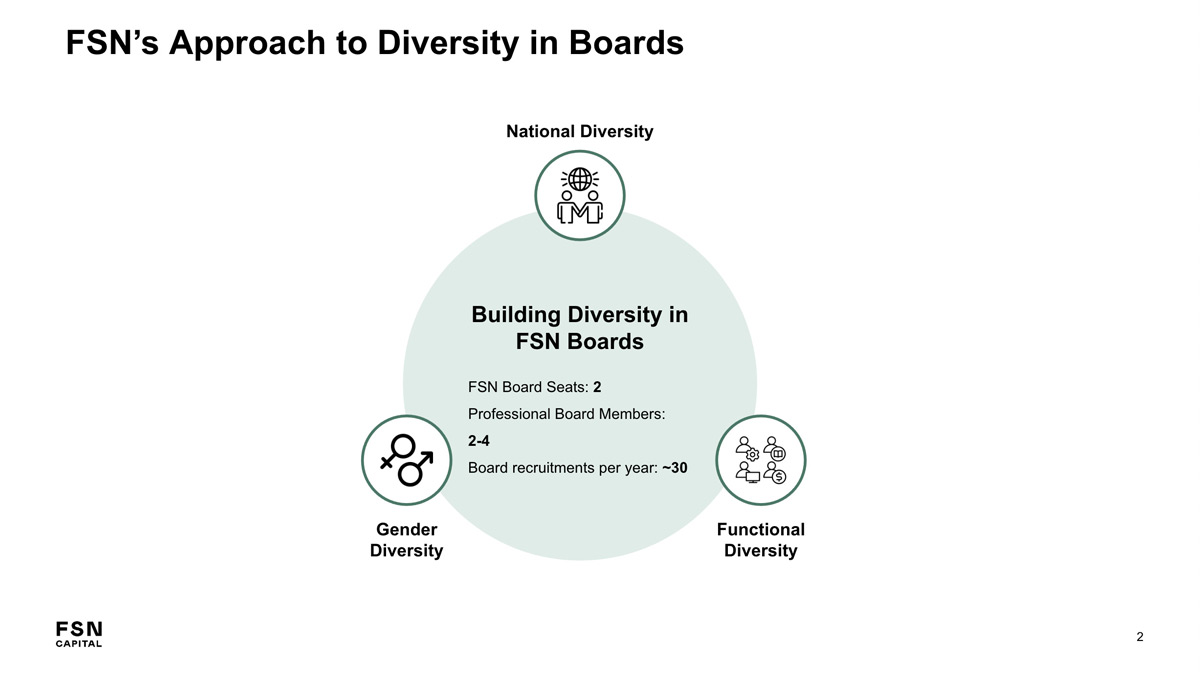

We promote three types of board-level diversity: gender-based, national, and functional

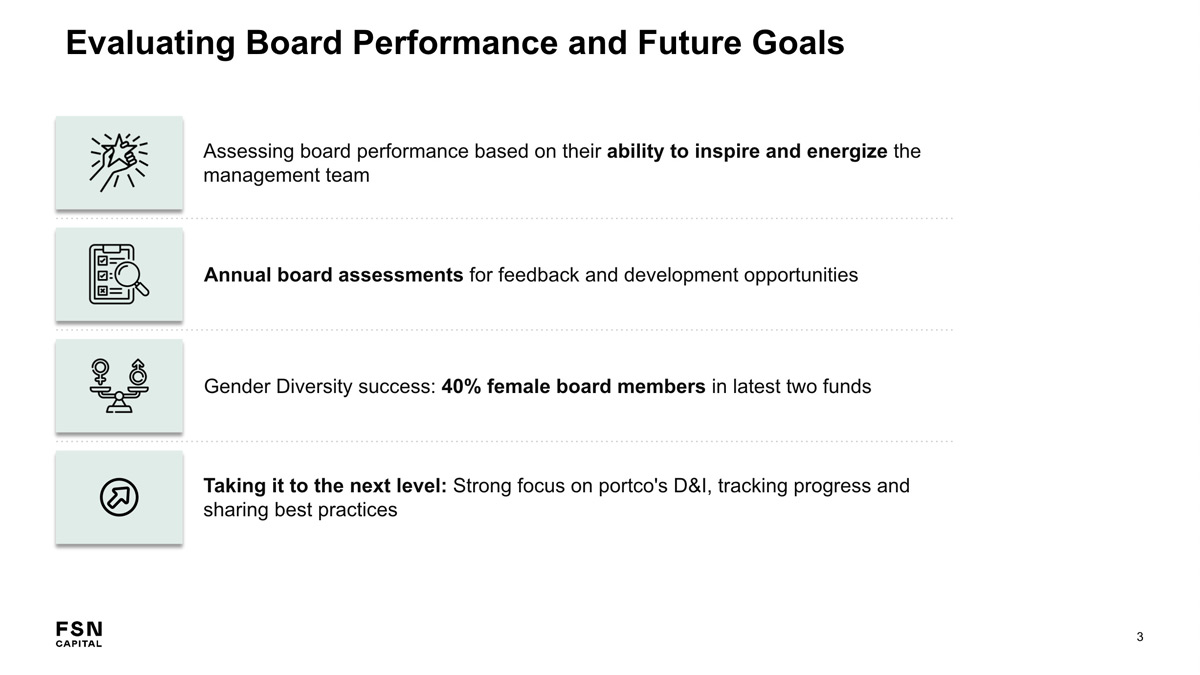

We are making good progress on board-level diversity – with more work still to be done

Jesper Isaksen, Partner and Head of Talent, discusses the importance of diversity on portfolio company boards of directors

See also

Should you have any questions about our ESG work, you are always welcome to contact the ESG team at esg@fsncapital.com